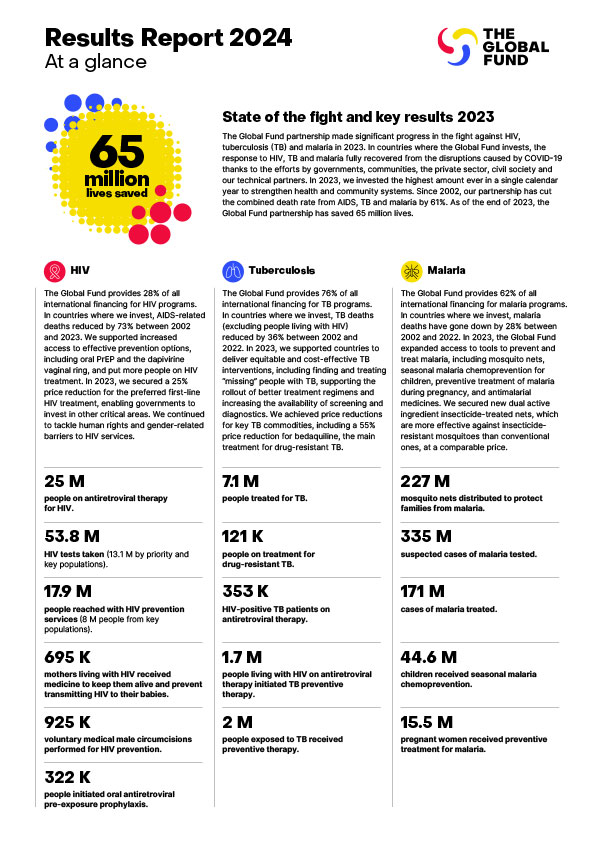

The Challenge

Significant investments in health over the past two decades have yielded striking progress in the fight against AIDS, tuberculosis (TB) and malaria. Much of that has come through domestic resource mobilization and traditional development assistance. But the health financing landscape is shifting, countries are facing significant economic pressure, and these three diseases are constantly evolving to become more difficult to beat. In response to these challenges, the Global Fund partnership is pursuing new opportunities to add more funding and increase value for money to accelerate the fight to end HIV, TB and malaria as public health threats.