Rising debt burdens in many low- and middle-income countries are putting significant pressure on spending for the social sector, including for health.

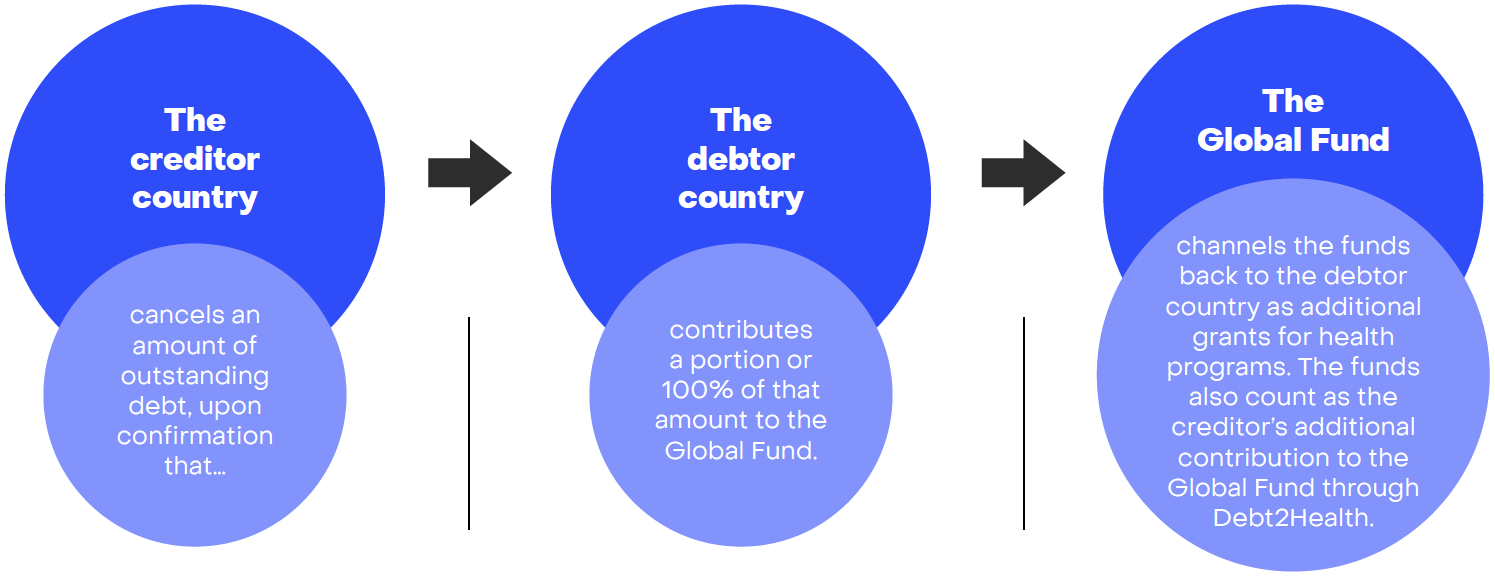

Debt2Health, the Global Fund’s debt swap program, aims at reversing a small part of this trend by allowing creditor and debtor countries to convert – or swap – part of their debt into lifesaving health investments. Currently focused on the conversion of official bilateral debt, all swaps are flexibly and independently negotiated in partnership with the Global Fund and are designed to meet the needs of creditor and debtor countries alike.

Debt2Health offers a unique and innovative financing model to help unlock essential new funds for national responses to fight HIV, tuberculosis (TB) and malaria, strengthen health and community systems, and build pandemic preparedness.

The Global Fund has a worldwide track record in debt conversions for health, with 14 transactions involving three donors (Australia, Germany and Spain), converting close to US$500 million of bilateral debt into US$330 million in health funding for 11 debtor countries.

The Debt Swap Process

While each debt swap agreement is unique, all transactions follow an overarching process.

Debt2Health: Unique Advantages

- A win-win-win proposition: The creditor country converts a bilateral claim into targeted funding for health for selected recipients and gains global visibility as a sponsor of innovative financing for health. The debtor country converts debts into additional funding for lifesaving programs in line with its national health strategy.

- A cost-efficient, proven platform: The Global Fund uses established and proven grant implementation systems for the disbursement, execution, monitoring, auditing and reporting of Debt2Health-supported programs.

- Transparency: Most Debt2Health transactions involve official development assistance (ODA) debt, with transparency ensured through rigorous creditor compliance standards. In a non-ODA debt swap such as the 2010 Australia–Indonesia swap on commercial debt, the Global Fund partnered with Export Finance Australia, the Australian Department of Foreign Affairs and Trade (DFAT), and an Indonesian NGO to ensure the convertibility of the underlying credits. The D2H swap enabled TB treatment for 115,000 additional people and prevented over 20,000 infections.

Debt Swap Case Studies

Germany has been the leading supporter of Debt2Health, both in piloting the concept in 2007 and in supporting the scheme as a creditor in multiple subsequent transactions. In 2024, through Debt2Health, Germany signed agreements with Mongolia and Indonesia to convert €29 million and €75 million of these countries’ respective debts into public health investments.

Mongolia

In 2024, Germany and Mongolia signed a €29 million debt conversion agreement to bolster Mongolia’s public health system. Facilitated by KfW Development Bank and Mongolia’s Ministry of Finance, the debt swap redirected debt repayments into critical health investments. The funds will enhance TB care, expand HIV services for vulnerable populations and support Mongolia’s transition to a more integrated and efficient health system.

Indonesia

Germany and Indonesia signed the largest ever Debt2Health agreement in 2024, converting €75 million of Indonesia’s debt into vital public health investments.

The funds will support malaria control, enhance diagnostic capabilities and promote local pharmaceutical production. An additional focus is on TB – Indonesia has the world’s second-highest TB burden. The investment will expand screening, improve access to medicines and strengthen community-based TB programs.

This agreement marks a pivotal step in Indonesia’s transition from international to domestic health financing. By redirecting debt repayments into sustainable health initiatives, the partnership exemplifies how innovative financing can drive long-term health resilience and increased self reliance.